prince william county real estate tax payments

The second and all subsequent installments are due on the 5th of each month with the final payment being due on June 5th. Ad Search Prince William County Records Online - Results In Minutes.

Join Renew Realtor Association Of Prince William

Press 1 for Personal Property Tax.

. Your tax bill must have the statement Principal Residence on it. You will need to create an account or login. This tax is based on property value and is billed on the first-half and second-half tax bills.

Payments may be made to the county tax collector or treasurer instead of the assessor. This tax is perfect addition to Prince William Countys real estate tax. By creating an account you will have access to balance and account information notifications etc.

Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. In Prince William County Virginia the tax rate is 105 which is. Report a Vehicle SoldMovedDisposed.

See Results in Minutes. Press 1 to pay Personal Property Tax. The real estate tax is paid in two annual installments as shown on the tax calendar.

Have pen paper and tax bill ready before calling. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. There are several convenient ways property owners may make payments.

The Prince William County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Prince William County and may establish the amount of. Press 2 to pay Real Estate Tax. By mail to PO BOX 1600 Merrifield VA 22116.

-- Select Tax Type -- Bank Franchise Business License Business. Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return. Please contact us at.

You can pay a bill without logging in using this screen. Report a New Vehicle. However we can assist you in linking your real estate account.

By phone at 1-888-272-9829 jurisdiction code 1036. This estimation determines how much youll pay. Report a Change of Address.

The county assessed home. If your real estate account does not show on the My Accounts screen it is because real estate account types generally do not automatically link when registering. Enter your payment card information.

The average homeowner will pay about 250 more in Real Estate taxes and fire levy taxes next year. Follow These Steps to Pay by Telephone. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. The property tax calculation in Prince William County is generally based on market value. Semiannual payments are offered for owner-occupied residential property only.

Paying Your Property Tax The Prince William County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. The county proposes a new 4 meals tax to be charged at restaurants.

What is different for each county and state is the property tax rate. Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure. Payments may then be made in 2 equal installments - the first by September 30th and the second by December 31st.

340200 9 hours ago the median property tax also known as real estate tax in prince william county is 340200 per year based on a median home value of 37770000 and a median effective property tax rate of 090 of property value. Press 1 for Personal Property Tax. This tax is based on property value and is billed on the first-half and second-half tax bills.

Median Property Taxes No Mortgage 3767. Find Prince William County Property Tax Info From 2021. Tax Payments - Prince William County Virginia.

Prince William County - Home Page. Median Property Taxes Mortgage 3893. Report changes for individual accounts.

Enter the Account Number listed on the billing statement. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Prince William County Property Tax Payments Annual Prince William County Virginia.

The County also levies a supplemental real estate tax on newly-constructed improvements completed after the. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date.

Click here to register for an account or here to login if you already have an account. You can pay a bill without logging in using this screen. Press 2 to pay Real Estate Tax.

The system will verbally provide you with a receipt number for you to write down. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. When are property taxes due in Virginia County Prince William.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. When prompted enter Jurisdiction Code 1036 for Prince William County. Provided by Prince William County.

Prince William County accepts advance payments from individuals and businesses. Payments Tax bills must be paid by September 30th in full unless paying semiannually. The first monthly installment is due July 15th.

Included on the real estate tax bills is the special district tax for the gypsy moth abatement program.

Strategic Plan For Prince William Schools Focuses On Academic Achievement Emotional Wellness Headlines Insidenova Com

Now Accepting Applications Restore Retail Grant Program

Prince William Prosecutors Seek More County Funding Headlines Insidenova Com

The Rural Area In Prince William County

Manassas Virginia Old Town Manassas Manassas Virginia Manassas Virginia

More Data Centers For Prince William County S Innovation Park Wtop News

New Facility Will Grow Prince William County S Composting Capabilities News Prince William Insidenova Com

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimes Com

Pathway To 2040 Small Area Planning

Us State And Local Tax Changes Due To Covid 19 Our Commercial Real Estate Services Altus Group

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

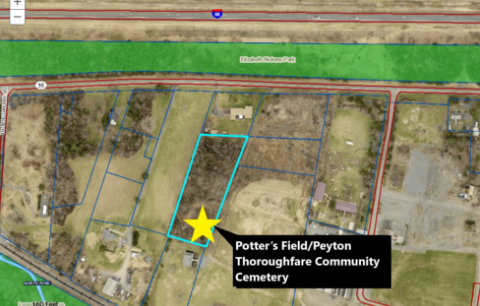

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

Class Specifications Sorted By Classtitle Ascending Prince William County

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

According To The Realtor Association Of Prince William A Total Of 827 Homes Were Sold In August 2020 An I Prince William County Prince William Housing Market

Digital Realty Ups The Ante In Data Center Alley Data Center Knowledge News And Analysis For The Data Center Industry